Over the past few years, the UK rental market has experienced significant fluctuations, with rents increasing dramatically during the Covid-19 pandemic. Between 2020 and 2022, demand far exceeded supply, driving rents to unprecedented levels.

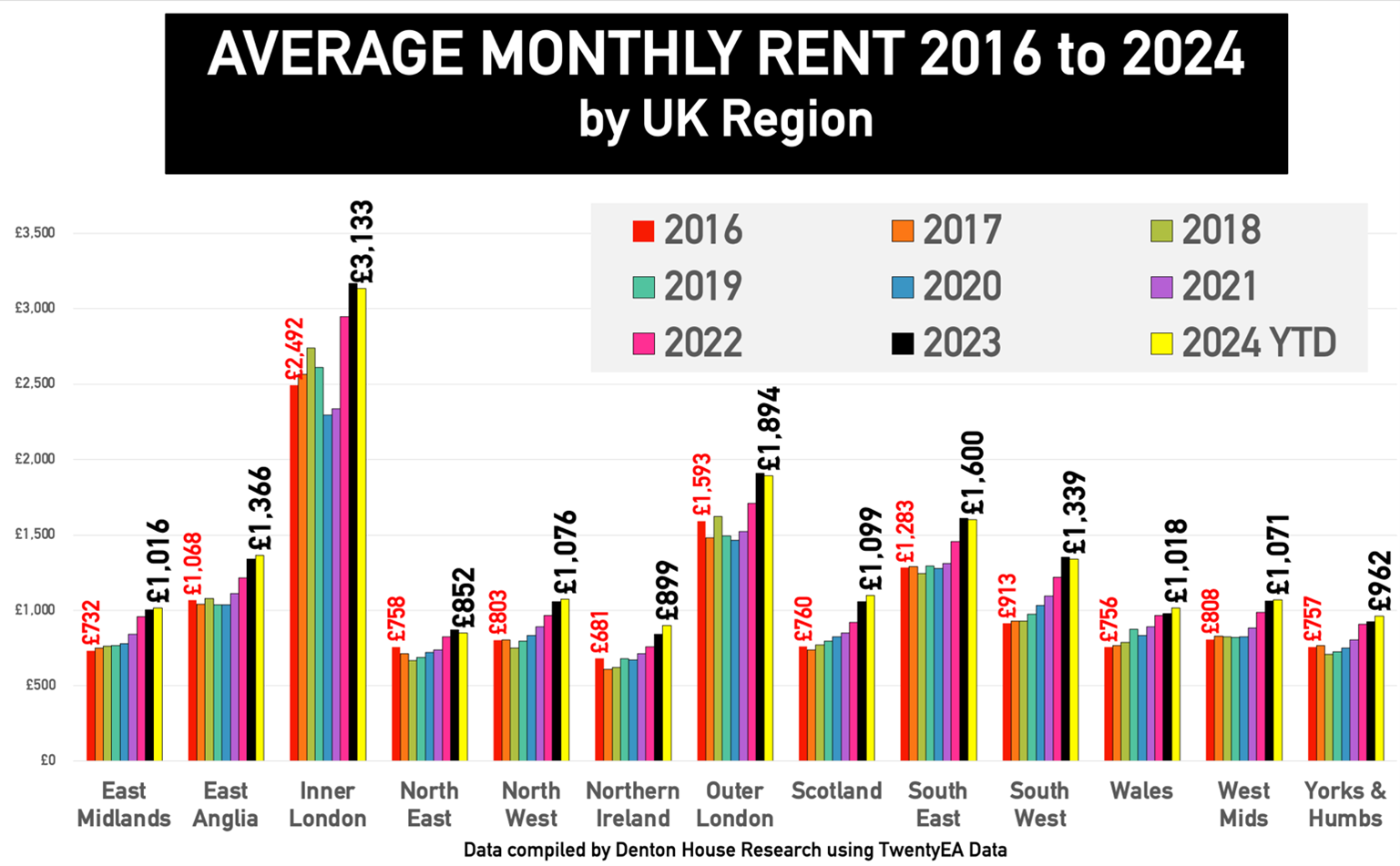

In the North East for example, the average rent has risen from £758 per calendar month (PCM) to £852 pcm YTD in 2024.

However, the last 12 months have seen a slight increase in the number of properties available for rent, both nationally and regionally, leading to a more balanced market. This article will explore these trends and see if the same is happening in Low Fell.

National and Regional Trends in Buy-to-Let

Nationally, the rental market has witnessed a notable shift in the last 12 months. During the pandemic, many factors contributed to the surge in rental prices, including the migration of people seeking more spacious living conditions and the disruption of new housing developments. As restrictions eased, the rental market gradually started to show signs of stabilisation. According to recent statistics, there has been a slight uptick in the supply of rental properties across the UK coming onto the market, which has helped to temper the rapid rise in rents.

In April 2023, 87,592 UK rental properties came on to the market. This number increased by 14.86% to 100,614 in April 2024.

Regionally, the North East is slightly behind this national trend where 2,532 rental properties came on the market in April 2023. This increased to 2,668 rental properties in April 2024, a rise of 5.4%.

In April 2023, the average rent achieved for a new UK rental property was £1,641pcm. The average rent increased by 8% to £1,772pcm in April 2024.

A far cry from the national double digit percentage increases in the mid to late teens only 12/18 months before.

The North East mirrors this national trend in rent increases. The average for those new properties that came on the market in April 2023 was £769pcm. This increased to £843pcm for those that came on the rental market in April 2024, a rise of 9.6%.

The increased availability of rental properties has brought some relief to tenants, who had been grappling with steep rent hikes of +20% per annum for some types of properties. Despite this increase in supply, the demand for rental properties remains robust, ensuring that rental yields continue to be attractive for landlords.

The Low Fell Rental Market

In Low Fell, the rental market followed a similar trajectory in the post pandemic years of 2021/2, as rents surged due to a significant imbalance between supply and demand.

Therefore, let us look at the most recent Low Fell statistics to see if that pattern has followed through to us.

In this analysis, we have looked at the first four months of 2023 versus the first four months of 2024. The reason we have done this is because if we were only to look at April of each of those years for Low Fell, it would be such a small sample size that the results would not be ideal.

Therefore, looking at the first four months of 2023, 127 rental properties came onto the market in the Low Fell area (NE9) with an average rent of £786pcm.

In the first four months of 2024, 114 Low Fell properties have come onto the market for rent and the average rent has been £784pcm, so very little change in rent.

Why Low Fell Buy-to-Let Remains a Strong Investment

Despite the recent market adjustments, Low Fell remains a compelling investment opportunity for several reasons:

1. Strong Rental Demand: Low Fell’s rental market continues to benefit from strong demand. The area's attractive location, good transport links, and quality of life make it a desirable place to live, ensuring a steady stream of potential tenants.

2. Affordable Property Prices: Compared to other regions, Low Fell offers relatively affordable property prices. This affordability, combined with solid rental yields and long-term stable capital growth, makes it an appealing option for buy-to-let investors.

3. Economic Growth and Development: Low Fell is experiencing economic growth, with ongoing developments in infrastructure and amenities. This growth not only enhances the quality of life for residents but also boosts the rental market by attracting more people to the area.

4. Long-Term Investment Potential: The recent stabilisation in the rental market suggests a move towards long-term sustainability. For landlords, this means the potential for consistent rental income and capital growth over time.

Addressing Low Fell Tenant Concerns

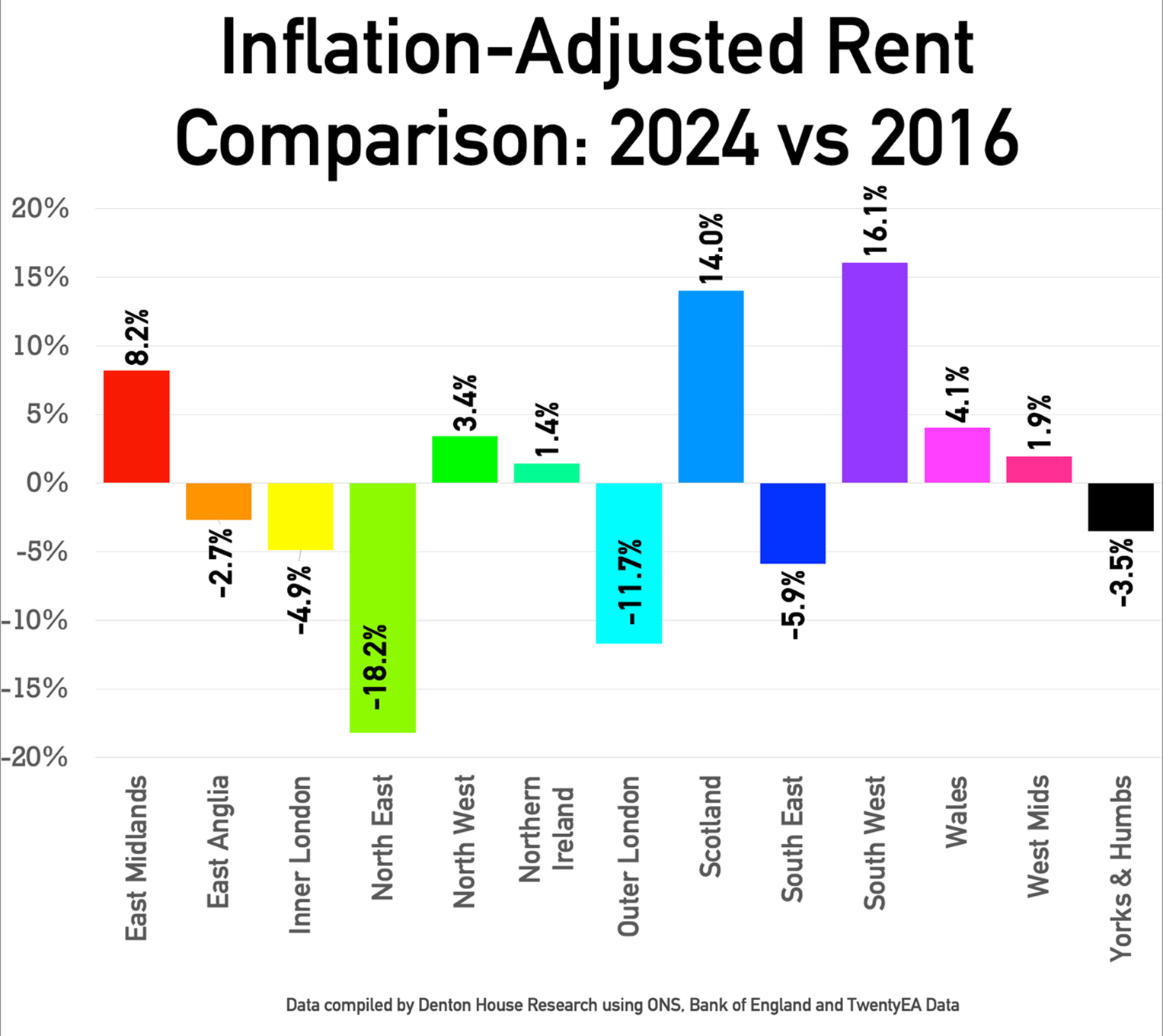

It's important to address the concerns of Low Fell tenants who may feel burdened by the recent rent increases. While it's true that rents have risen significantly, it's worth noting that these increases have generally aligned with inflation rates over the medium term (since 2016). This means that, in real terms, the cost of renting has not increased disproportionately.

For tenants in Low Fell, the slight increase in rental supply offers a glimmer of hope. A more balanced market could lead to more competitive rental prices and better opportunities to find suitable housing. Landlords should be mindful of maintaining good relationships with tenants, recognising the importance of fair and transparent rental practices.

The Future of Buy-to-Let in Low Fell

Looking ahead, the Low Fell buy-to-let market appears poised for continued stability and growth. Landlords should take advantage of the current market conditions to expand their portfolios. The combination of strong demand, affordable property prices, and the area’s economic prospects make Low Fell a smart investment choice.

For those considering entering the buy-to-let market, now is an opportune time. The national and regional stabilisation of rental prices indicates a mature and sustainable market, reducing the risks associated with volatility. By investing in Low Fell, new landlords can benefit from the area's attractive rental yields and long-term house price growth potential.

As a property agent, I like to stay informed about these trends and communicate them to everyone interested in the Low Fell property market. By highlighting the area's potential investment opportunity for landlords whilst addressing tenant concerns, we can foster a healthy and thriving rental market that benefits all parties involved.

Report a Maintenance Issue

Report a Maintenance Issue