Navigating the property market in Low Fell? Understanding the current market dynamics is essential whether you're looking to buy a dream home or sell a cherished property. Recent data reveals a fascinating surge in property transactions across the UK, with Low Fell included in all this bustling activity.

As of April 2024, property sales and listings have increased significantly, indicating a robust market. Yet, what does this mean for you? Is Low Fell a buyers’ market, favouring those looking to purchase, or a sellers’ market, giving an edge to those wishing to sell?

This article delves into the latest figures and trends, offering crucial insights and strategic advice for prospective buyers and sellers in Low Fell. Read on to discover the opportunities in this dynamic property landscape and how you can best navigate it to your advantage.

Up to Sunday, 21st April 2024, the number of UK homes that went under offer (sold STC) was 10.3% higher than during the same period in 2023.

(377,217 home sales agreed on YTD in 2024 compared to 341,271 YTD in 2023)

Even more interesting when we compare the average of 2017/18/19 year to date (YTD) sales agreed figure of 351,027.

Every UK region has seen an increase in the number of properties selling (subject to contract). Yet what is more interesting is that the different regions of the UK property market have shown a remarkable uniformity in growth across the country for the YTD in 2024, signalling robust health and widespread confidence.

Leading the charge, Inner London showcased a stellar rise of 21.09%, closely followed by Outer London at 20.47%, reinforcing the enduring appeal of the capital. East Anglia and the South East were not far behind, registering impressive gains of 19.65% and 19.48%, respectively, underscoring the continuous attractiveness of the South East. The Midlands, both East and West, also enjoyed substantial growth at 18.20% and 18.02%, indicating a resilient market presence. Up North, the North West at 17.70% and Yorkshire & Humber at 17.27% demonstrated significant upward movement, whilst the South West advanced with a respectable 16.11% increase.

The North East, Wales, Scotland, and Ulster presented growth figures of 14.74%, 14.00%, 12.43%, and 12.38%, respectively, suggesting a balanced expansion across the entire UK. Although most pronounced in London and the South East, the growth spectrum exhibits a promising scenario for the UK property sector, with the narrow gap between the highest and lowest growth regions illustrating a cohesive national uptrend.

In addition to increased property sales, the supply of UK properties on the market in April 2024 was 11.8% higher than in April 2023.

(654,913 properties for sale in April 2024 versus 585,741 for sale in April 2023)

This increase in the number of properties for sale is good news, as it gives buyers greater choice.

Even if you sell your property, there's no guarantee that it will go through to exchange of contracts and completion. Thankfully, 2024 sale fall-throughs are at 22.5% of gross sales YTD, which is much lower than the 7-year average of 24.3%.

Net sales (house sales agreed less sale fall throughs) paint an

even better picture, with a rise of 12.6% year on year.

(295,912 net sales YTD 21st April 2024 vs 262,871 net sales YTD 21st April 2023)

Prospective purchasers and vendors are witnessing a rise in confidence as mortgage rates, after climbing sharply last year, have begun to decline recently. Inflation stands at 3.8%, a steep fall from the 9.6% high of October 2022. Furthermore, average mortgage rates have settled, with many banks and building societies now offering decent rates. For example, at the time of writing, Nat West was offering a 5-year fixed rate of 4.37% for those with a 30% deposit, Virgin Money a 5-year fixed rate of 4.69% with a 10% deposit and the Leeds Building Society a 5.14% 5-years fixed for those with a 5% deposit.

Despite these positive signs, Low Fell house price levels are expected to hold steady, with the market remaining buyer-friendly due to mortgage affordability issues.

The easing of mortgage costs (compared to the summer of 2023) has undoubtedly sparked renewed interest and dealings in the property market, particularly after a lull period in the second half of last year, when many considering a move put their plans on hold. This revitalisation is anticipated to boost the volume of homes sold, which had dipped to an 11-year low of just over one million in 2023.

Nevertheless, it's unlikely this momentum will cause a marked rise in house prices in 2024, with the market maintaining a delicate equilibrium, in contrast to 2021's full-on extreme sellers’ market.

Low Fell homeowners planning to sell in 2024 may be buoyed by this uptick in market activity; however, they should temper their expectations as buyers remain keen on value, which could dampen the current pace of recovery in the property market. Caution is also advised due to the traditional hesitance seen in the property market during a general election year, with buyers and sellers often taking a more conservative approach as the election looms.

This is the time to be realistic with your pricing if you’re

going to put your Low Fell home on the market.

So, what sort of market are we in?

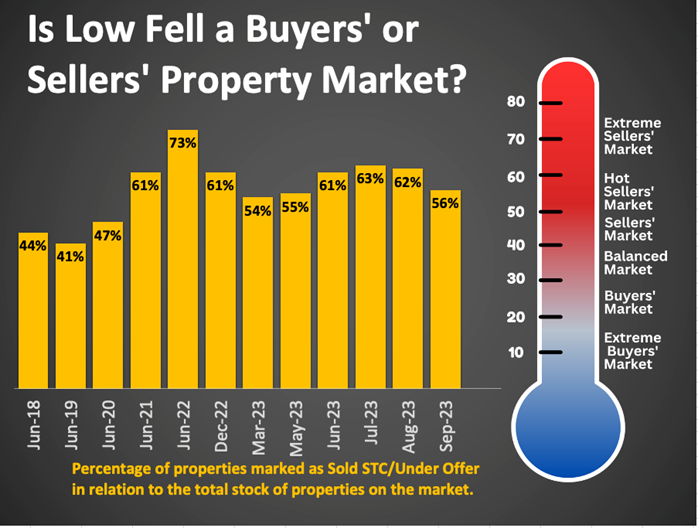

The measurement of whether it's a buyers', balanced, or sellers' market is based on the proportion of properties marked as "Sold STC" and "Under Offer" compared with the total number of properties on the market. For example, if there are 43 properties sold STC and 100 properties available/for sale, then 43 as a percentage of 100 is 43%.

This isn't just a numbers game; it's a gauge of market sentiment:

• Extreme Buyers' Market (0%-20%)

• Buyers' Market (21%-29%)

• Balanced Market (30%-40%)

• Sellers' Market (41%-49%)

• Hot Sellers' Market (50%-59%)

• Extreme Sellers' Market (60%+)

The weight of these brackets can’t be overstated. They directly impact everything from listing prices to negotiation leverage.

Current Low Fell Property Market Snapshot

To calculate Low Fell's property market's current status, let's incorporate our most recent findings for April 2024. The numbers and statistics have been taken from the website 'The Advisory', which has calculated the market state for many years. I am sharing them from the summer of 2018 to April 2024.

• The Low Fell postcode district of NE9 showed an extreme sellers’ market at 73% in the summer of 2022, which eased off towards the end of the year.

• Throughout 2023, the Low Fell property market was in the mid 50% to mid 60% range (a hot sellers’ market and an extreme sellers’ market). As expected, because of the seasonal nature of the property market, by February 2024, this had reduced to 50%.

• Since February 2024, it has increased to 55%.

The Consequences and Thoughts for Low Fell's Property Market

This new data prompts me to take stock and ponder.

For Low Fell sellers: We are transitioning into a market where sellers must be more strategic, flexible, and patient. It would help if you braced yourself for your home to be on the market for longer with an extended marketing period. Realistic pricing is even more vital than ever. Setting at the right price is crucial for attracting suitable buyers.

Why? Because your chances of selling your Low Fell home have dropped in the last few years.

In the spring of 2022, 82.95% of Low Fell homes that were on the market sold and completed. Since 1st January 2024, that figure has dropped to 66.33%.

Your marketing strategy is just as important. Employing tools such as video or virtual tours, targeted social media campaigns, or interactive property listings could be particularly beneficial in this more ‘normal’ market of 2024.

For Low Fell buyers: Expect intense competition if you're interested in highly sought-after types of properties. Securing mortgage pre-approval can put you ahead of other prospective buyers. Consider expanding your search area to discover potential deals that others may overlook. Conversely, in less competitive markets, Low Fell buyers have more leverage to negotiate, from the offer price to inclusions like carpets, fixtures, and fittings. You will also have the luxury of choice and time with other homes.

Remember, four out of five sellers are also buyers, so what you may lose on the sale might be compensated for on the purchase.

External influences, such as global economic trends, inflation and interest rate repercussions, could all cast shadows on the Low Fell property market. The election will undoubtedly affect the Low Fell property market, as everything will go on ice in the three or four weeks before the election itself.

Final thoughts: As we progress into the fifth month of 2024, the Low Fell property market presents challenges and opportunities for buyers and sellers. Understanding these market subtleties is crucial for anyone considering a move, from existing homeowners to seasoned buy-to-let investors, first-time buyers or those looking to relocate to Low Fell.

Stay flexible, stay informed and remember that your home-moving experience is as much about the journey as the destination.

What are your thoughts on Low Fell's developing property market?

Do you anticipate any other shifts or trends in the Low Fell property market?

What are your local insights and experiences?

Report a Maintenance Issue

Report a Maintenance Issue