Could the high levels of mortgages that Whickham people take out cause another property crash?

Many Whickham homeowners and landlords have been contacting me recently and asking what will happen to the Whickham (and the UK) property market? More specifically, will we have a repeat of the 2008/9 Credit Crunch property crash?

High mortgage payments were one of the critical catalysts to Whickham house prices dropping by between 16% and 19% (depending on the type of property) in just over one year in Whickham.

To answer that question, let me look at the mortgage numbers locally to see where we stand in the Whickham area.

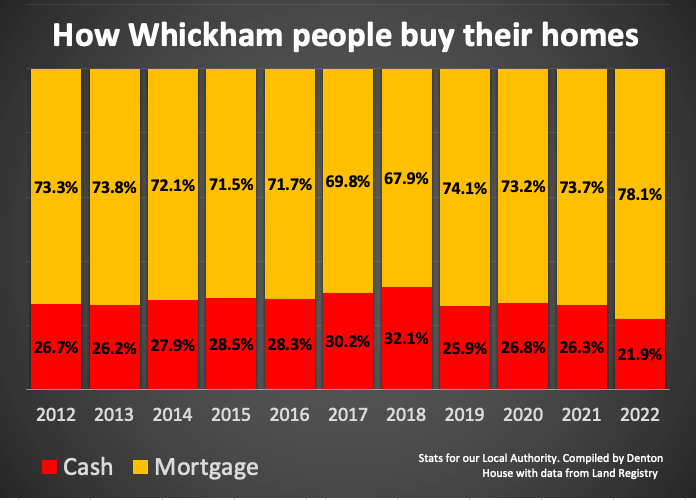

18,229 of the 25,263 property sales in the last decade in

Gateshead were made with a mortgage.

72.2% of our local authority area house purchases have been made with a mortgage (meaning 27.8% are made with 100% cash).

Interesting, when compared with the national average of 67.4% of house purchases with a mortgage over the last decade.

However, what is thought-provoking is the number of house purchasers buying with a mortgage has been increasing over the last decade.

Between 2012 and 2017, the percentage of people buying with a mortgage was 72%, yet over the last five years in Gateshead, that has risen slightly to 73.4%.

Initially, this doesn't sound good. Yet, as always with my articles on the Whickham property market, the devil is always in the detail.

The issue is that most people need a mortgage to buy their home.

However, it’s not the amount of mortgage that is the issue, more the level of monthly payments. So, if you fix your mortgage rate, then your payments are fixed (a good idea especially as interest rates are on the rise).

In the last quarter, just under nineteen out of twenty (94.35%) of new borrowers that took out a mortgage had a fixed-rate mortgage at an average interest rate of 1.84%.

That’s good news for recent buyers as most of their payments won’t rise even though Bank of England interest rates have risen over the last few months. Yet it’s essential to see what existing homeowners with mortgages have done with their mortgage rates (i.e. fixed or not) as they form the bulk of the property market.

This is because in 2008/9 (the last crash), many people were unable to afford their high monthly mortgage payments when they were made redundant because interest rates were much higher. This meant many Whickham homeowners ‘dumped’ their houses onto the market, all in one go in 2008, because they couldn’t afford their high mortgage payments.

Also, the banks could not lend money for mortgages as easily because of the Credit Crunch, meaning fewer people could get a mortgage, so the demand for Whickham houses dropped as well.

In a nutshell, the number of Whickham properties on the market almost doubled overnight in 2008, yet demand plummeted as mortgages were hard to come by. High supply and low demand meant Whickham house prices nosedived in 2008/9.

Going into the Credit Crunch, one in six (60.4%) homeowners with a mortgage had a fixed rate at an average of 5.76%. By 2013, this had dropped to one in three people (33.29%) having a fixed-rate mortgage at an average of 3.34%.

Yet today, just under 17 out of 20 homeowners with a mortgage have a fixed rate at an average of 1.97%.

Whilst the country might owe collectively £1,630.5 billion in mortgages, irrespective of increasing rates, most homeowners have protected themselves with a low fixed interest rate.

Also, the overall ratio of mortgage debt in the UK, compared to the value of the homes the mortgages are lent on, is also low compared to the year before the last property crash. This ratio is called the Loan to Value ratio (LTV). The higher the LTV, the less equity the homeowner has in the property.

In 2007 (the year before the crash), only 49.4% of people had a mortgage less than 75% of the house's value (i.e. they had an LTV of less than 75%). Today that stands at 60.9%, which means more people have more equity in their property.

Another thought on why the country is in a better position is only 4.22% of mortgages have a 90% or higher LTV (compared to 16.28% just before the crash in 2007).

1 in 6 people were vulnerable to negative equity in the last property crash, whilst today that would only be 1 in 25.

This means if we do have another property market correction for any other reason ... the number of people in negative equity will be much smaller, so it won't affect the property market as much.

So, in conclusion, as we have fewer people with high LTV mortgages and fixed rates that are a third of what they were in the Credit Crunch, we are, as a country, in a better position to weather any storm.

If you would like any advice or opinion on the Whickham property market, be it buying or selling or anything to do with investing in the Whickham buy-to-let property market, don't hesitate to drop me a line.

Sarah Mains

Director

Report a Maintenance Issue

Report a Maintenance Issue